- Fraud Awareness Events

- New rules for victims of Authorised Push Payment Fraud

- How we protect you

- Fraud alerts

- Top 5 Travel Tips

- Support for victims of financial crime

- Banking fraud control comparison data

- Take Five to Stop Fraud & UK Finance educational material

- Scamwise NI

- Brochures

Fraud Awareness Events

Bank of Ireland UK cares about keeping your money safe. To help protect you, we’re offering free fraud awareness events.

These events will take place across Northern Ireland. The locations and dates are listed below. We will announce more events soon.

| Area | Location | Date | Time |

|---|---|---|---|

Subject to change

Remember to Stop, Think, Check… and together we won’t let the fraudsters win.

Events are also taking place in the Republic of Ireland; dates and locations of these events can be found here: Security Zone – Bank of Ireland Group Website.

New rules for victims of Authorised Push Payment Fraud

No one ever wants to fall victim to crime, and fraud is the most reported crime impacting communities across the UK.

As well as the financial impact, there can be emotional and trust impacts, that come due to fraud attempts and activity, which is why we do what we can to help protect you from fraudsters.

We offer:

- Information and advice on protecting yourself from fraud, available on our website

- Free fraud awareness presentations in venues and for groups across Northern Ireland

- Support from the “Take-Five” Fraud Awareness Campaign

- Free after-care and professional support from Victim Support

In addition we regularly monitor customer transactions, and we may phone you or send you a text to ask about activity on your account.

It’s important to know that if we do contact you, at Bank of Ireland UK, we will never:

- Ask you for your PIN;

- Ask you for your password;

- Ask you to transfer money to a safe account.

When a customer falls victim to fraud, we follow industry best practice for customer support to ensure a consistent and fair outcome.

The UK Payment Systems Regulator (PSR) has announced that when a consumer falls victim to an Authorised Push Payment (APP) Fraud using Faster Payments or CHAPs, they should be reimbursed as quickly as possible.

These rules apply to payments made on, or after, 7 October 2024. The changes will be reflected in our updated Terms and Conditions in due course.

It’s important that you continue to be cautious when you make payments from your account. Reimbursement is not guaranteed in all cases; some exemptions apply. There’s more information about how to protect yourself against authorised push payment fraud on the security and fraud pages of the Bank of Ireland UK website.

Online Security

Our online banking websites are secure and encrypted to keep your information safe. Please use a secure browser to see your account details and make payments. We also use a firewall to protect our internal bank network.

Logging in and Timing out

When you log in to Bank of Ireland 365 online, we’ll ask for:

- Your own User ID

- 3 random digits from your 365 login PIN

- A push notification will be sent to your registered mobile device or PSK asking you to approve the login by swiping.

This information is encrypted and stays private as long as you don’t share it.

- For Business Online customers, you can see your last log-in details when you log in, so you’ll know if someone else has accessed your account.

- If you’re inactive for a while, your online banking session will log you out after 5 minutes.

Two Factor Authentication

- You need Two Factor Authentication to add or change a payee on 365 online.

- We’ll send a code to your registered mobile phone or send it by post if you prefer.

Protecting your business with Bank of Ireland Approve

- Business On Line uses HID Approve. Approve has been developed by BOI’s chosen security partner HID Global, an industry leader in secure authentication solutions.

- Approve creates unique, one-time Secure Codes for logging into Business On Line and authorising payments and payees.

Approve offers the following security benefits:

- You need a PIN to generate Secure Code. Each code is used only once and expires once used after 60 seconds.

- Approve doesn’t store any information.

- Approve only works on your registered device, with your own Business On Line User ID

- The app is registered to the individual user.

- The Business On Line Administrator can lock a User’s profile if needed (for example, if the User go on holidays, etc.)

Read more about Approve here

Daily Control limit

- The Administrator and your relationship manager will set a Daily Control Limit (DCL) on your Business On Line profile.

- This limit reduces the risk of fraud.

Delayed Payment options

When making a bank transfer, you can schedule the payment for a later date instead of sending it right away. You can cancel the payment up until midnight the day before it’s due by using the BOI app or 365 online. This delay lets you think things over and talk to a trusted person or your bank before sending the money.

Card Spend Alerts

Card Spend Alerts is a new service that Debit and Credit Consumer customers can use. You must opt in for this service. If you opt in, whenever you attempt a transaction using your card (whether the transaction is successful or not), you will receive a spend alert push notification to your device in near real time. This allows you to monitor whenever transactions are being attempted using your card.

Protect your Business from Fraud (Business On Line customers)

We have created a helpful checklist of tools available through Bank of Ireland Business On Line to help protect your online banking security here

Fraudsters are sending fake emails and letters claiming to be from the National Crime Agency (NCA). The emails and letters:

- Threaten that the NCA has evidence of the recipient accessing and viewing illegal content online (“child pornography” or “illegal pornographic content”).

- Requests payment of a fine to avoid prosecution.

- Demands a response within a specified time.

- Warns that if payment is not received, a warrant for the recipient’s arrest will be issued and they will be added to the sex offenders register.

- Refers to relevant legislation.

Please Stop, Think Check.

The NCA, your bank or any other official organisation will not send unsolicited emails or letters requesting money, your financial details or your personal information.

If you receive any correspondence like this please contact the NCA.

Fraudsters are calling Bank of Ireland UK (BOI UK) customers and tricking them into authorising payments from their account. The fraudster initially informs the customer they are calling to help set up new users on the Business On Line system, once the new user is set up the customer is directed to set up or authorise a payment; this payment is sent to the fraudster. Fraudsters can make a fake call look like it’s coming from a genuine phone number – If you’re not sure hang up.

We are committed to keeping your everyday banking secure so you can manage your accounts and payments with confidence.

To protect your business from fraud, read our guidance Protect your business from Fraud for a checklist of actions you can take.

While we may contact you to discuss the operation of your account, to send you product related messages, or for feedback on your banking experience, please remember the below points, and hang up if something doesn’t feel right.

BOI UK will NEVER:

• Send you a text or email with a link directly to the login page of our online banking channels.

• Send you a text or email with a direct link to your latest e-Statement.

• Ask you to click a link in an email with an urgent warning about suspicious activity on your account. (We may sometimes send you an email to verify a transaction on your account but we will never ask you to provide confidential information or click a link to verify a transaction).

• Ask you to share or send us your full six-digit 365 PIN, four-digit card PIN or Business On Line credentials

• Ask you to send us back your bank card

• Ask you to transfer money out of your account to protect yourself from fraud.

• Request your account information through an onscreen pop-up window.

• Call you to ask you to make a payment to another account.

• Ask you to tell us any ‘one-time password’ or code that you have received from us by text.

BOI UK will ask you for:

• Three random digits from your 6-digit 365 PIN – never more, never less.

• Your full 365 online user ID and

• Either your date of birth or the last four digits of your phone number – never both

Fraudsters are contacting members of the public claiming to be from Bank of Ireland UK (BOIUK) offering information on investments/ investment bonds. Bank of Ireland UK does not offer investment services. If you receive any correspondence claiming to be from BOIUK, offering investment services this is a scam. You may receive this correspondence by phone call, email, text, post, or through social media messages.

Examples of the BOIUK Investments scam emails

Please click on the below links to see examples of the BOIUK Investment Scam emails.

How to keep safe

BOIUK does not offer investment services, if you receive any correspondence claiming to be from BOIUK offering investment services, do not respond and do not provide your personal details or financial information.

If you are considering an investment, before you make any decisions, please remain vigilant against scams. You can do this by independently checking the authenticity of the company you are dealing with. You can check the FCA Warning List of firms to avoid. Learn more by visiting the for guidance on how to avoid investment scams.

We encourage you to Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

You should always

In regards to phone calls/emails/text messages

- Be suspicious of any unexpected call/text message from a ‘financial advisor’ or any type of account manager who offers you investment opportunities

- Be especially doubtful if the offer is ‘time-limited’ or offering very high returns, also even if the offer seems reasonable still question it

- Be alert if they put pressure on you, don’t leave you enough time to think about the investment and the risks that this entails

- It is a red flag if they keep calling/messaging/emailing you and try to convince you taking the deal after you refused their offer

- Preferably either reject these calls or after considering the above point hang up on them

- In case of text messages/WhatsApp/Facebook/Telegram etc messages/emails mark as spam and block these numbers/email addresses

Finding a good investment deal online?

- Be wary of adverts offering investment or crypto opportunities on social media

- Check the offer/s using the Financial Conduct Authority (FCA) Warning List online tool

- Also check if the firm is regulated: FCA Financial Services Register

- If it in an unregulated firm that means the firm is not authorised to give financial advise to UK residents and you will not receive any protection

- Never invest more than you can afford to lose and never take on credit commitments e.g. loans to invest

- Always consider all the risks for short term and long term – it might benefit you in a short term however it can have consequences in the long run

- Use a legitimate source to find a financial advisor like this: Getting financial advice – Citizens Advice

- Use the FCA website to see unauthorised firms and advisors: Unauthorised firms and individuals | FCA

- Preferable invest with a firm that is UK based rather overseas

Report Fraud

If you suspect suspicious activity on your account, or if you have provided personal information in response to a suspicious email, text or telephone call, please contact us as soon as possible on the below contact numbers:

Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

365 Online: 0345 7 365 555

Great Britain

365 Online: 0345 7 365 333

Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365

Abroad

365 Online: +44 345 7365 555

365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

To report suspicious Bank of Ireland related emails or texts, send the suspicious email or text to 365security@boi.com

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

Screen Scraping

Screen scraping is the act of taking the information that a person or company has posted on their website or social networking page and then using that information for another purpose i.e. the purpose of defrauding. Cybercriminals can use screen scraping to impersonate genuine companies selling anything from expensive jewellery, designer handbags, cars or even holiday lets!

Sadly screen scraping can also be used on fake dating profiles, which can be used to snare someone into a romance scam.

What to look out for

If you are ever in doubt, use Google to find out if the image has been used elsewhere on the web:

- Save image of the item you’re looking at to your computer / phone

- Go to Google Images (https://images.google.com)

- Click Search by image (camera icon)

- Drag the image or upload it

- Select the image you’ve saved in Step 1

- Click Open or Chose

If the image comes back with a number of search results, it’s been previously used. This could be indicative of a scam, especially if the seller location was different.

Unfortunately, it can be challenging to identify false items such as items for sale, property (including holiday lets) or people misrepresenting themselves – especially online.

You should always

- Use established sites when purchasing online

- Check if the seller offers a returns policy, terms and conditions and a privacy policy

- Consider if the price is reasonable – or potentially too good to be true

- Check the wording for spelling mistakes or poor grammar

- Check seller reviews and consider:

- How long has the seller been established

- Are there too many positive reviews, bearing the above in mind

- Are all the reviews overly positive – is the grammar correct

- Avoid paying off-platform if possible – ideally Bank transfers should not be made

- If purchasing a large item – such as a vehicle – arrange to pay a small deposit and balance upon collection. If the seller refuses then it may be appropriate to consider why

- Recommend that you consider seeing (using something similar to Google Image Search) to see if the same pictures have previously been used.

Bank of Ireland will never

- Send you an email with a link directly to the login page of our online banking channels.

- Send you an email with a direct link to your latest e-Statement.

- Ask you to click a link in an email with an urgent warning about suspicious activity on your account. (We may sometimes send you an email to verify a transaction on your account but we will never ask you to provide confidential information or click a link to do this).

- Ask you to transfer money out of your account to protect yourself from fraud.

- Ask you to share your full six-digit 365 PIN or Business On Line credentials

Bank of Ireland UK would like to warn our customers about Cost of Living scams, and what you can do to protect yourself from falling victim to a Cost of Living scams.

What is a Cost of Living scam?

Fraudsters will take the opportunity to abuse the cost of living crisis. The government announced on the 26th of May that they provide support for vulnerable households across the UK, also there is an energy bills discount due to come in October furthermore they offer a payment of £150 council tax rebate to households living in council tax bands A – D (these will be made from April 2022 and will not need to be paid back), etc. These payment are automatic, which means there is no application process.

For more information please see the links below:

Council tax rebate: factsheet – GOV.UK (www.gov.uk)

Millions of most vulnerable households will receive £1,200 of help with cost of living – GOV.UK (www.gov.uk)

Government support for energy bills and the cost of living – factsheets – GOV.UK (www.gov.uk)

Cost of Living Payment – GOV.UK (www.gov.uk)

What to look out for

- If someone contacts you offering deals and refunds on energy bills

- Fraudsters can set up fake loan websites offering low interest rates, asking for you to pay a one-off admin fee etc in advance

- If someone pretends to be calling you from the council, or the government requesting your bank details to process payments

- If someone comes to your home and offering a price cut on your prepayment meter – decline the offer

Protect yourself

- HMRC won’t send you an email, text message, message in an application (e.g. WhatsApp, Snapchat, Telegram, Messenger etc) asking for personal and/or payment information

- HMRC do not leave a voicemail threatening legal action

- HMRC do not call you threatening arrest

- HMRC use QR codes to help you complete your payments

- Do not click on any links received by emails or texts

- HMRC do not rush or threaten you to act

Please see links for more information:

Identify HMRC related scam phone calls, emails and text messages – GOV.UK (www.gov.uk)

Bank of Ireland UK would like to warn our customers about screen sharing scams, and what you can do to protect yourself from falling victim to a screen sharing scam.

What is a screen sharing scam?

A screen sharing scam is when a criminal convinces you to download screen sharing software then steals your personal and financial information for their gain. You may believe that you’re dealing with a legitimate company, or with a genuine friend/ partner you trust. The screen sharing software is usually legitimate software, however once you have downloaded the software and allow the criminal to take control of your screen, they can obtain your personal and financial information and use it to take over your account and to apply for accounts/credit in your name.

Criminals are using sophisticated tactics to make people believe they are dealing with a trustworthy individual/business and that’s why it’s safe to download screen sharing software. Some common tactics are listed below.

Romance/ friendship screen sharing scams

Romance scams usually start with people meeting online; through dating websites or social media. Criminals often use fake profiles and spend a lot of time getting to know you to convince you that you are in a genuine relationship. Once the criminal believes they have gained your trust they will ask you to download screen sharing software. The criminal will then use your personal and/or financial information to either take over your account, or to apply for credit in your name.

What to look out for

When you are dating someone online, look out for the below alarm bells:

- Requests for you to download screen sharing software.

- Requests for you to apply for a loan or other banking product in your name.

- Requests for your personal data (e.g. a copy of your passport to arrange travel).

- Requests for money or gifts from someone you have never met in person.

- Does the person’s profile look genuine? You can complete a reverse image search to find if their profile picture has been taken from somewhere else.

Protect yourself

- Never download software that provides someone with access to take over your device.

- Be cautious when providing your personal information. The more information you provide about yourself the easier it is for a criminal to steal your identity.

- If you notice any of the above alarm bells don’t be pressured into downloading screen sharing software, transferring money, sending gifts, or giving someone your personal and financial details.

- Never reveal your banking information to anyone, including your account details, online banking information, card number & pin.

- Never apply for credit in your name with the intention that the funds are for someone else.

- Follow us on Twitter @BankofIrelandUK to be informed of trending scams.

Investment Screen sharing scams

An investment scam is when a criminal convinces you to move money to an account, you will believe your funds have been moved to an investment account and that you will start to see returns on your investment in the future months/ years. However, in reality your funds have been moved to an account controlled by the criminal, and it is unlikely you will recover these finds. Criminals are now using screen sharing software to assist them with investment scams.

The criminal reaches out to you pretending to be from a legitimate investments company. This could be after you have researched investment opportunities, or it could be an out of the blue phone call, email, text social media message or a pop-up. Bitcoin/ cryptocurrency scams are a common Investment scam in 2022. The criminal convinces you that you should download the screen sharing software to assist with the ‘investment opportunity’ then uses your personal and/or financial information to either take over your account, or to apply for credit in your name.

What to look out for

- Being asked to give control of your device to process the investment opportunity.

- Clone Firm: A clone firm is when criminals clone the website of a genuine investment firm.

- Fake Firm: A fake firm is when a criminal sets up a fake investment firm; they will create a fake investment firm name, and may set up a fake website.

- Fake account manager/ financial adviser: A Fake account manager/ financial adviser is a criminal who will pose as a genuine financial adviser, they may inform you that they are independent, or work for a genuine investment firm.

Protect yourself

Criminals may lead you to believe you are dealing with a genuine firm/financial adviser by using fraud tactics. Follow the below steps to help protect yourself from investment scams:

- Never download software that provides someone with access to take over your device.

- Reject unexpected investment offers made online, through social media, by email, text and telephone calls.

- REMEMBER: Cryptocurrencies are not regulated in the UK, or covered by the Financial Services Compensation Scheme.

- Search the investment firm/individual details on the Financial Conduct Authority (FCA) register and check:

- If investment firm/individual is registered; all individuals and companies providing investment services within the UK must be listed on the FCA register.

- What activities and services the firm/individual have permissions to provide; if the activity or service the firm/individual is offering is not listed this could be a scam.

- The firm/individual’s contact details; if these differ to the contact details you have for the firm/individual this is likely a scam. You should always use the contact information for the investment firm/individual that is listed on the FCA register.

- Consider getting impartial advice through a financial adviser. Please complete the FCA register checks listed above on your financial adviser.

- Talk to your trusteed friends and family about your potential investments.

- Remember that if it’s too good to be true it probably is, criminals will try to convince you into investing with a too good to be true offer.

- Don’t be rushed into making an investment; genuine financial advisers and investment firms will not pressure you into making a rushed decision.

- Beware that fraudsters can spoof Caller ID numbers to make it look as though they are calling from a legitimate company.

- Follow us on Twitter @BankofIrelandUK to be informed of trending scams.

Technical Support and IT companies screen sharing scams

This occurs when criminals contact you by email, text, phone call or social media message pretending to be from a reputable technical support or IT company. They persuade you to allow them to take control of your computer remotely so that they can fix, upgrade or protect your computer. They may ask you to log on to your online banking account or ask for bank, credit card or other personal details.

Protect yourself

- Never download software that provides someone with access to take over your device.

- Never log on to your online banking while a third party is connected to your device, even if the caller is very persistent, or someone you think you can trust.

- Never transfer money out of your account based on an instruction from a cold caller. Or someone you have never met, no matter what story you are told.

- Don’t disclose full personal or banking details to an unsolicited caller.

- Don’t click on links sent to you by email, text or social media. Instead search of the company using your browser.

- Don’t disclose your Visa Debit or credit card details.

- Beware that fraudsters can spoof Caller ID numbers to make it look as though they are calling from a legitimate company.

- Follow us on Twitter @BankofIrelandUK to be informed of trending scams.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

Bank of Ireland UK would like to remind our customers to remain vigilant against fraud this Christmas period. With Black Friday and Cyber Monday approaching, criminals are attempting to target new victims. Please see below for information on the common Christmas period scams, and how you can protect yourself.

Purchase Scams

Purchase scams occur when a victim pays in advance for goods or services that they never receive. Criminals often use social media platforms, online market place and auction websites to target victims, the victim may not realise they have been a victim of a scam until they do not receive the goods or services they paid for.

How to protect yourself

Criminals may lead you to believe you are dealing with a genuine seller by using fraud tactics. Follow the below steps to help protect yourself from purchase scams:

- Remember, if it’s too good to be true it probably is. Do some research on the person /company/ website before making a purchase.

- Don’t click on links sent to you by email, text message or social media. Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Ask to see the product in person with the relevant documentation to prove ownership before making a payment.

- Where possible, use a credit card as you may receive protection under Section 75 of the Credit Consumer Act.

- Use the secure payment method recommended by reputable online retailers and auction sites and be suspicious of any requests to pay by bank transfer.

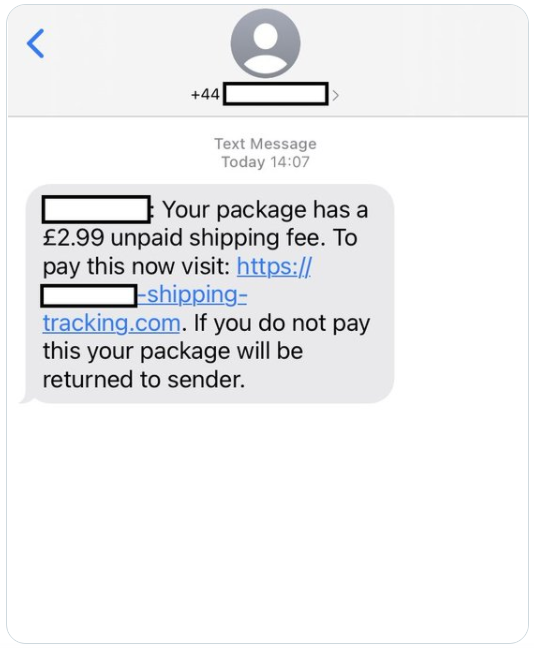

Parcel Scams

Parcel scams occur when a victim is duped into making a payment, or providing their personal/ financial information to criminals posing as delivery services. The victim may receive correspondence by email, text or post from criminals posing to be a well-known delivery service, the criminals claim that they have been unable to deliver parcels or large letters.

How to protect yourself

Criminals may lead you to believe you are dealing with a genuine delivery service by using fraud tactics. Follow the below steps to help protect yourself from parcel scams:

- Don’t click on links sent to you by email, text message or social media.

- Whether you are expecting an item or not, if you receive correspondence to say that an item could not be delivered – Don’t click on the links; check the advice on the retailers / delivery services’ genuine website. Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Report suspected scam text messages to your mobile network provider by forwarding the text message to 7726 (SPAM).

Take Five to Stop Fraud

We encourage you to #ShopSavvy this Christmas period, and to #Take Five by following the below steps:

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

- If you’re asked to pay by bank transfer not with a secure payment option – that is a red flag

- You should not be asked for security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- You can always change your mind and not go with an offer if you feel it is dodgy

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Check if the Bank of Ireland UK text is legitimate

You can check the legitimacy of any Bank of Ireland UK text you receive, using our new ‘TextChecker’ service, simply send the word ‘Check’ followed by the Bank of Ireland UK message you want to verify, to 50365.

We will reply to confirm if we sent the Text Message to you or if it’s a scam.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

Summary

Criminals are sending fake emails, text messages, and social media messages pretending to be genuine charities and organisations raising funds for victims of the Ukraine-Russia war.

The fake emails, text messages and social media messages may contain bank account details for donation, or a link to a fake website that will be used to take donations, and capture personal and financial information. The criminals then keep the funds for their own gain.

How to avoid falling victim to these scams

If you receive an email, text, or social media message as described don’t click on the link or send funds to the account details provided. Donate to your chosen charity by searching for the name of the charity/organisation in your search engine and making a donation through their website.

Please remember, there is an extensive number charities & organisations that are genuine and who are making a big difference to the lives of the victims of the of the Ukraine-Russia war (Bank of Ireland choose to donate to UNICEF Ireland, click here to read our Ukraine crisis communications).

When making a donation, do research on your chosen charity/organisation by following the below steps:

- Check the charity’s name and registration number using the charity register

- Search the charity’s name on your search engine to find if there is any negative media about the charity being a scam.

- Always go directly to the charity’s website to make a donation by searching the charity’s name on your search engine.

- Never provide your personal and financial details in response to a cold call, email, text message or social media message.

- For more information on how to donate safely please refer to the dedicated page ‘Ukraine: what you can do to help’ on GOV.UK

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

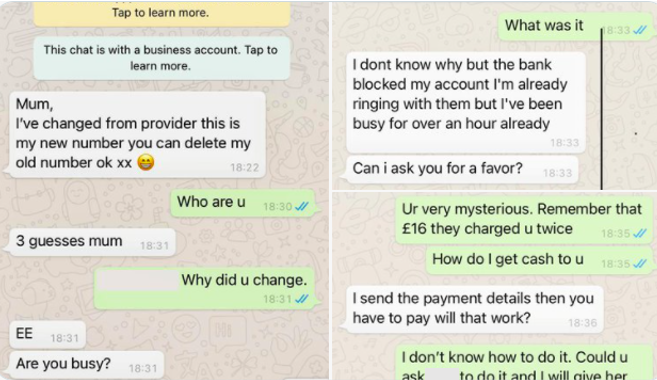

Known as the “mum and dad” or “friend in need” scam criminals are sending text messages through WhatsApp, claiming to be a friend or family member texting from a new number as they have lost or damaged their phone. Often the text message will start with “Hello mum” or “Hello Dad”, once they receive a reply they will claim that they need urgent funds to buy a new phone, or pay a bill. The criminals then send their bank details to receive the requested payment, and if successful may text again asking for more funds.

How to protect yourself

Criminals are targeting people by making them think that a loved one is in need of cash urgently – if you get a text message as described above take the following steps to protect yourself:

- Notice that your son/daughter/other family member/ friend’s name is NOT specified on the text message.

- Don’t assume that the person texting you is genuine – try to contact them by another method, for example through the phone number you already have for them, by email or though social media.

- Don’t send money without speaking to the person first to confirm the request is genuine.

- If you find that the request is not genuine:

- Report suspected scam text messages to your mobile network provider by forwarding the text message to 7726 (SPAM).

- Send a screenshot of the suspicious text message to 365security@boi.com.

- Delete the text messages and block the number so the criminal cannot continue to text you.

- Follow us on Twitter @BankofIrelandUK to be informed of trending scams.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

Parcel scams occur when a victim is duped into making a payment, or providing their personal/financial information to criminals posing as delivery services. Criminals send text messages posing to be a delivery service, including well-known delivery companies, the criminals claim they have been unable to deliver parcels or large letters and ask for personal and or financial details to be able to arrange delivery of the parcel.

The criminals will then use your personal and/or financial details to try to scam you out of your money. Ways they could use your information include:

- Identity theft occurs when someone steals your personal information and uses it to impersonate you. They can carry out fraudulent activity such as trying to access your bank accounts, opening a credit card account in your name or getting payment from a supplier.

- Authorised Push Payment (APP) scams occur when criminals dupe an individual into authorising a payment from their bank account. The first four digits of a bank card number are specific to that person’s bank, so if an individual disclosed their card details to a criminal, that criminal can identify the bank that individual banks with, then may call that person posing to be calling from the bank and dupe them into making a payment to a ‘safe account’.

How to protect yourself

Criminals may lead you to believe you are dealing with a genuine delivery service. Follow the below steps to help protect yourself from parcel scams:

- Don’t click on links sent to you by email, text message or social media.

- Whether you are expecting an item or not, if you receive correspondence to say that an item could not be delivered – Don’t click on the links; check the advice on the retailers / delivery services’ genuine website. Search for the website by typing it into the web browser. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Report suspected scam text messages to your mobile network provider by forwarding the text message to 7726 (SPAM).

- Send a screenshot of the suspicious text message to 365security@boi.com.

- Delete the text messages and block the number so the criminal cannot continue to text you.

- Follow us on Twitter @BankofIrelandUK to be informed of trending scams.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

Criminals are calling people posing as their bank, they can manipulate the phone number that appears on your caller ID so it appears they are calling from the genuine bank. They are informing customers that their account has been compromised & asking them to transfer funds to a ‘Safe account’. The criminals provide bank account details for an account they control as the ‘safe account’, then quickly transfer the funds from the ‘safe account’ so that the funds cannot be traced or recovered once identified as a fraudulent transaction.

How to protect yourself

Criminals are targeting people by making them think that their account has been compromised, and that you must transfer your funds urgently to protect them. If you get a telephone call as described above take the following steps to protect yourself:

- Don’t assume that the person calling you is genuine, even if the phone number matches the one on the back of your card, or on the banks website.

- Never provide your financial and/or personal information on a call you receive.

- Never send money when you have been asked to transfer funds to a ‘safe account’ – just hang up the call.

- A legitimate company will understand if you want to hang up and call them back on the phone number from their website. Hang up, and call the company on the number provided on their website. When entering login details or personal information, be sure the web page you are viewing offers encryption of your data by checking:

- The web address (URL) has changed from ‘http’ to ‘https’.

- That a closed padlock icon is present.

- Your browser address window may be green.

- Follow us on Twitter @BankofIrelandUK to be informed of trending scams.

- If you are concerned that you have divulged personal and/or financial details on a call inform your bank as soon as possible by calling the number on your banks website or the number on the back of your card.

- Remember, Bank of Ireland UK will NEVER ask you to transfer money to a ‘safe account’ – if you receive a call like this just hang up.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

Criminals have become extremely sophisticated in investment scams. UK Finance found that the value of losses reported in the UK from investment scams in the first half of 2021 was £107.7M, this is a 95% increase compared to the first half of 2020, which seen £55.2M losses reported in the UK from investment scams. As it is evident that investment scams are becoming more sophisticated BOI UK would like to inform our customers about investment scams, and how you can protect yourself.

What is an investment scam?

An investment scam is when a criminal convinces a victim to move their money to an account, the victim will believe their funds have been moved to an investment account and that they will start to see returns on their investment in the future months/ years. However, in reality the victim’s funds have been moved to an account controlled by the criminal, and it is unlikely the victim will recover their finds.

Look out for the below types of investment scams when investing.

- Clone Firm: A clone firm is when criminals clone the website of a genuine investment firm. They will reach out to potential victims by putting adverts on social media and search engines, they may also reach out to potential victims by phone call, email and text message, and provide the link to their clone website.

- Fake Firm: A fake firm is when a criminal sets up a fake investment firm; they will create a fake investment firm name, and may set up a fake website. They will reach out to potential victims through online adverts on social media and search engines, and by phone call, emails and text messages.

- Fake account manager/ financial adviser: A Fake account manager/ financial adviser is a criminal who will pose as a genuine financial adviser, they may inform you that they are independent, or work for a genuine investment firm.

How to protect yourself

Criminals may lead you to believe you are dealing with a genuine firm/financial adviser by using fraud tactics. Follow the below steps to help protect yourself from investment scams:

- Reject unexpected investment offers made online, through social media, by email, text and telephone calls.

- Search the investment firm/individual details on the Financial Conduct Authority (FCA) register and check:

- If investment firm/individual is registered; all individuals and companies providing investment services within the UK must be listed on the FCA register.

- What activities and services the firm/individual have permissions to provide; if the activity or service the firm/individual is offering is not listed this could be a scam.

- The firm/individual’s contact details; if these differ to the contact details you have for the firm/individual this is likely a scam. You should always use the contact information for the investment firm/individual that is listed on the FCA register.

- Consider getting impartial advice through a financial adviser. Please complete the FCA register checks listed above on your financial adviser.

- Talk to your trusteed friends and family about your potential investments.

- Remember that if it’s too good to be true it probably is, criminals will try to convince you into investing with a too good to be true offer.

- Don’t be rushed into making an investment; genuine financial advisers and investment firms will not pressure you into making a rushed decision.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

What is a money mule?

A money mule is someone who accepts the profits of crime into their bank account, then transfers most of the funds from their bank account to another account/s as instructed by criminals, and keeps some funds as payment for helping the criminal.

How does someone become a money mule?

Criminals approach people in person and online with offers to make quick and easy money. However, accepting and moving funds on behalf of a criminal is illegal, and can have serious consequences.

Why are students more vulnerable to becoming a money mule?

Students are more vulnerable because criminals target students – criminals approach students by contacting them near to school, college, university, sports clubs, or other places young people socialise. Criminals also attempt contact through social media, or job advertisements that promise a quick and easy way to make money.

What you can do as a student/ guardian of a student to keep safe

- Beware of job advertisements that might seem genuine but promise a quick and easy way to make money, and simply ask that you have a bank account.

- Don’t be tempted to allow your own bank account to be used to move money to other accounts.

- Always verify any ‘working from home’ opportunities to make sure that the business is legitimate, such as by checking their contact details (address, landline phone number, email address and website).

- Never share your Banking 365 logon details, passwords, or security codes with anyone, criminals may try to take over your account and use it as a money mule account.

- Remember that moving stolen money is illegal and can have serious consequences.

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

What is a Phone number spoofing scam?

Fraudsters can manipulate the phone number that appears on your caller ID so it appears they are calling from a legitimate company. A phone number spoofing scam is when a fraudster calls you from what appears to be a legitimate company and tricks you into providing them with your financial and/or personal information or make a payment.

How can I tell if it’s the legitimate company calling me or a fraudster?

It’s difficult to identify spoofing telephone calls, however fraudsters calling you have an agenda; they want to obtain your personal and/or financial information. As a tactic they often add an urgency or a threat to the call, for example they may say that your bank account or bank card has been compromised.

What should I do if I receive a call and have been asked for my information?

- Never provide your financial and/or personal information on a call you receive.

- Fraudsters who call your landline can stay on the line for up to 5 minutes after you hang up – wait for more than five minutes before you make another call, or use your mobile.

- A legitimate company will understand if you want to hang up and call them back on the phone number from their website. Hang up, and call the company on the number provided on their website.

Bank of Ireland UK will NEVER ask you to transfer money to a new, or ‘safe’ account so ignore such calls or texts.

Take Five to stop fraud

We encourage you to Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting or you calling back

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

Contact us straight away if you are concerned, suspect fraudulent activity on your account or have lost your payment card.

Emergency Contact Numbers

You can contact us 24 hours a day, 7 days a week on:

Calling from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Calling from ROI

Freephone: 1800 946 764 (personal and business)

Calling from Overseas

Not Freephone: 00353 567 757 007

Report a suspicious email or text

To report suspicious Bank of Ireland UK related emails or texts (both personal and business customers), send the suspicious email or text to 365security@boi.com

Please note: If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

The purpose of this alert is to warn Bank of Ireland UK customers about Smishing scams and how to protect yourself from becoming a victim of fraud.

What it Smishing?

Smishing is when a fraudster sends you a text message posing to be from a legitimate business & tricks you into providing them with your financial or personal information.

What does a Smishing text look like?

Smishing text messages can seem genuine as they can appear in the existing thread of text messages with a legitimate business. Some things to look out for include:

- The threat that urgent action is needed or there will be negative consequences.

- They may ask you to click on a link directing you to a website, or to provide a number to call in order to “verify” or “update” your personal current account.

- Fake links lead to fake websites where you may be asked to provide personal information. The fraudster then uses that information to transfer money from your account.

- Text messages claiming to be from your bank, asking you to confirm financial or personal information.

What you can do

Don’t focus on the details of the text message & follow this simple rule: If you receive a text message with a link asking for your financial or personal information do not click on the link. If you think the request for information is genuine, contact the business directly.

You should never:

- Click on or open suspicious links and attachments.

- Respond to unsolicited text messages.

- Share your banking details, including your full online banking PIN, or other personal information if requested via text message.

- Use a phone number provided in the text which could be fake.

If you have clicked on a suspicious link, call us as soon as possible on the emergency contact numbers listed below.

Bank of Ireland will never:

- Send you a text with a link directly to the login page of our online banking channels.

- Ask you to provide all the digits of your six-digit 365 PIN.

- Ask you to transfer money out of your account to protect yourself from fraud.

#Take Five to stop fraud

We encourage you to #Take Five by following the below steps:

- Never disclose security details, such as your PIN or full banking password

- Don’t assume an email or phone call is authentic

- Don’t be rushed – a genuine organisation won’t mind waiting

- Listen to your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

Report Fraud

If you suspect suspicious activity on your account, or if you have provided personal information in response to a suspicious email, text or telephone call, please contact us as soon as possible on the below contact numbers:

Northern Ireland

Freephone (Personal accounts): 0800 121 7790 (24 hours, 7 days a week).

365 Online: 0345 7 365 555

Great Britain

365 Online: 0345 7 365 333

Republic of Ireland

365 Online: 1890 365 200/ 0818 365 365

Abroad

365 Online: +44 345 7365 555

365 Opening hours: Monday-Friday: 8am-8pm, Saturday: 9am-5pm, Bank and Public holidays: 10am-5pm, Sunday: Closed.

To report suspicious Bank of Ireland related emails or texts, send the suspicious email or text to 365security@boi.com

If we need to contact you about a potential fraud on your account, we will do this via a secure channel including, but not limited to, SMS or email.

Top 5 Travel Tips

At Bank of Ireland UK (BOIUK), we know that anyone can become a victim of financial crime. We also understand that this can be very difficult for those affected. Victims may need both emotional and practical support. That’s why we’ve partnered with Victim Support (VS) to make sure our customers get the help they need after experiencing financial crime.

Who are VS?

VS is a charity that helps people affected by crime or traumatic events. They offer a range of services, including a special Fraud Support service for those who have been victims of financial crime.

What does VS do?

The Fraud Support Team within VS gives emotional and practical help to people who have been victims of financial crime. Each person gets a support plan that fits their needs, which may include:

- Ongoing phone support from a trained caseworker– you can work with the same person throughout your case.

- Practical advice on how to avoid being a victim of fraud again.

- Signpost to other agencies if needed.

The service is independent, confidential, and non-judgmental. Most importantly, it aims to help victims of financial crime. VS is separate from BOI UK, so anything you share with them stays private.

To learn more, visit their website at: https://www.victimsupport.org.uk/

Will VS help investigate my BOIUK fraud case?

No, VS does not investigate fraud cases for BOI UK.

Can VS Provide any financial support?

No, VS cannot give financial support or compensation.

How can I be referred to VS?

BOI UK customers can call a dedicated phone number for VS:

0808 168 9024 (available Mon – Fri 8am – 6pm).

You can also ask to be referred to VS when reporting fraud to us.

Report Fraud

To report fraud, you can phone us 24 hours a day, 7 days a week on the phone numbers below:

Phone from UK

Freephone: 0800 121 7790 (personal customers)

Freephone: 0800 032 1288 (Business On Line and Global Market Customers)

Phone from ROI

Freephone: 1800 946 764

Phone from outside UK and ROI

Not Freephone: 00353 567 757 007

If something looks like fraud on your account, we may phone you or send you a text or email to ask about it.

Lost or stolen card?

If you think your card has been lost or stolen, please phone us right away on these numbers.

We’ll cancel your card as soon as you tell us it’s missing and get a new card sent to the address we have for you in 5 to 7 working days.

See payments you did not make, paid from your account?

If you see payments you did not make, paid from your account, or anything that could be fraud please phone us right away on these numbers.

Shared your online login details?

If you have given your online banking details to someone, please phone us right away on these numbers.

Report a suspicious email or text

If you think an email or text from Bank of Ireland UK looks suspicious, send it to 365security@boi.com

Criminals stole a total of £1.17 billion through authorised and unauthorised fraud and scams in 2023. Banks were able to stop £1.2 billion of unauthorised fraud, which was 7% more than the previous year.

We can all help to reduce financial losses by remembering these steps:

STOP – take a moment to STOP and think before parting with your money or information.

CHALLENGE – Could it be fake? It’s okay to reject, refuse or ignore requests. Only fraudsters will try to rush or panic you.

PROTECT – Contact your bank right away if you think you’ve been scammed. Also report it to Action Fraud on 0300 123 2040 or visit www.actionfraud.police.uk.

If someone asks for your personal or financial information, stop and think. Even if they claim to be from the bank, police, or another trusted group, you need to take time to stop and think about what’s really happening.

You already know these basic rules to prevent fraud – just take a deep breath and stay calm to remember them.

- Never share your security details, like your PIN or full banking password.

- Don’t assume an email or phone call is real.

- Don’t be rushed – a genuine company will wait.

- Trust your instincts – you know if something doesn’t feel right

- Stay in control – don’t panic or make a decision you’ll regret.

UK Finance educational material

Take Five to Stop Fraud

For more information on the Take Five to Stop Fraud campaign, including advice for both individuals and businesses visit: https://takefive-stopfraud.org.uk/

UK Finance has worked in collaboration with the Met Police to create the Little Booklet of Investment Scams. This booklet covers the top eight investment scams and offers tips on how you can protect yourself. Click here to download it.

Scamwise NI

Scamwise NI aims to teach people about the dangers of scams and how they can protect themselves. It encourages open conversations about scams to help everyone recognise them.

Scamwise NI recommends using this simple scam test:

- Seems too good to be true

- Contacted out of the blue

- Asked for personal details

- Money requested

Then it is most likely a scam!

To learn more about scams and how to avoid them, check out these resources from Scamwise NI:

Brochures

To learn how to protect yourself from fraud, read our guidance. It will help you spot common scams and avoid them. To read and download our brochures, please see below: